- The Whale

- Posts

- 🐳 Sportsbook Tax Drama & Bitcoin's Exchange Exodus

🐳 Sportsbook Tax Drama & Bitcoin's Exchange Exodus

Plus a tastey sportsbet of the week

In Today’s Email:

🏛️ Colorado lawmakers eye sportsbooks' free bet loophole, operators sweat $12M tax hit

🐍 Lord Venom slot brings jungle fever with 15,000x max wins and... avocados?

📉 Bitcoin's exchange exodus hits 5-year low as corporate America goes shopping

💼 BlackRock exec drops bombshell: China might swap T-bills for Bitcoin

🥊 Betting guide: Why Eubank Jr. might make Benn regret that middleweight jump

LATEST CRYPTO CASINO NEWS

🎰 Colorado Wants to Rain on Sportsbooks' Free Bet Parade

Remember when your parents told you nothing in life is free? Colorado lawmakers are taking that lesson to the sportsbooks, proposing a bill that would tax operators on revenue from those sweet, sweet free bet promotions that keep bettors coming back for more.

The nitty-gritty: House Bill 1311 would eliminate sportsbooks' ability to deduct promotional wagers from their taxes starting September 2025. While Colorado's 10% tax rate is already among the lowest in the nation (New York leads the pack at 51%), the state thinks betting operators' promo deductions are leaving money on the table, about $12 million worth.

Big picture: Colorado's sports betting scene has been hotter than a Rocky Mountain summer:

• $6 billion+ in total bets last year (up 11.3%)

• $325 million in operator revenue (up 24%)

• $26.2 million in tax revenue (but that's peanuts compared to NY's $876 million)

Between the lines: While lawmakers are eyeing the extra cash for water conservation projects, this is yet another sign of why players are leaving to bet with crypto casinos.

GAME SPOTLIGHT

🐍Lord Venom: Where Jungle Meets Jackpot

Another day, another jungle-themed slot, but this one's got some serious venom in its bite. Lord Venom, is slithering onto screens with a max win that'll make your head spin faster than a cobra's strike… we're talking 15,000x your bet, folks.

The specs:

• 5x5 grid with (oddly specific) 19 paylines

• Above-average 96.2% RTP

• High volatility (naturally 💅)

Here's where it gets spicy: During the bonus rounds, you're hunting for Golden Eggs that can crack open to reveal multipliers up to 200x. Think Easter egg hunt, but make it rainforest rave. And if patience isn't your virtue, there's a "skip the line" bonus buy feature for 150x your bet.

Between the lines: The game's symbols read like a fever dream at the zoo, tigers, elephants, and... avocados? But the real star is the progressive win multiplier system that keeps stacking during free spins like a tower of jungle Jenga.

Bottom line: While the 19 paylines might occasionally leave you feeling like you've been snakebit, the potential for massive wins during the bonus rounds makes this slot more tempting than an apple in Eden. Just remember… in this jungle, the house always wins, but at least you'll have fun trying to prove otherwise.

If you’re based in the USA, you’ll need to turn on your VPN to access this service.

LATEST CRYPTO NEWS

🏦 Big Money's Bitcoin Shopping Spree Is Emptying Exchange Shelves

Remember when your mom said "they're not making any more land"? Well, they're not making any more bitcoin either, and corporate America seems to have gotten the memo. According to Fidelity Digital Assets, Bitcoin reserves on crypto exchanges have hit their lowest level since 2018, about 2.6 million BTC and falling faster than tech stock prices in 2022.

The numbers game:

• 425,000 BTC moved off exchanges since November

• Public companies scooped up 350,000 BTC in the same period

• Strategy (formerly MicroStrategy) is the biggest whale, grabbing 285,980 BTC (81% of all corporate purchases)

Between the lines: This isn't just your regular "crypto bros" moving coins to cold storage. We're talking suit-and-tie companies playing the long game, with even Asian firms like Metaplanet and HK Asia Holdings joining the party. Metaplanet's CEO is so bullish he's trying to double their 5,000 BTC stash this year.

Why it matters: When bitcoin leaves exchanges for corporate treasuries, it's like taking chips off the casino table… there's less to go around for everyone else. And with Fidelity expecting this trend to "accelerate in the near future," the supply squeeze could get interesting faster than you can say "HODL."

📉 BlackRock Exec: China Might Trade Treasury Bills for Bitcoin and Gold

Plot twist in the global financial chess match: China might be eyeing Bitcoin and gold as alternatives to its massive U.S. Treasury holdings, according to BlackRock's head of thematics Jay Jacobs. And this time, it's not just crypto bros spinning tales—we're talking about the world's largest asset manager raising eyebrows.

The backstory: Remember when the West froze $300 billion of Russia's assets faster than you can say "sanctions"? Well, that got some countries (looking at you, China) thinking twice about keeping all their eggs in Uncle Sam's basket.

The numbers don't lie:

• Bitcoin's showing some serious independence from U.S. stocks lately

• Gold ETFs are seeing major inflows

• China's sitting on a mountain of U.S. Treasury bills (and maybe getting nervous about it)

Between the lines: BlackRock's identified "geopolitical fragmentation" as the market's biggest plot twist for the coming decades. Translation: Countries are shopping for Plan Bs, and Bitcoin's looking more like digital gold than a tech stock these days.

Why it matters: When the world's largest asset manager suggests that global powers might start treating Bitcoin like a legitimate alternative to government bonds, it's probably time to pay attention. Just saying. 🤷♂️

SPORTSBET OF THE WEEK

🥊Bet of the Week: Eubank Jr. to Stop Benn in Championship Rounds

Looking for some weekend action that doesn't involve refreshing your crypto portfolio? We've got our eyes on Saturday's grudge match at Tottenham Hotspur Stadium, where Chris Eubank Jr. takes on Conor Benn in a family feud that's been marinating since their dads were throwing hands in the '90s.

The smart money's on Eubank Jr. (34-3), but here's where it gets juicy: We're calling a stoppage in rounds 10-12 at 7/1 odds. Why? Because math and history, friends.

The logic:

• Benn's jumping from welterweight to middleweight (like bringing a knife to a cannon fight)

• Eubank Jr. has a 74% KO rate against bigger guys than Benn

• Previous welterweight-to-middleweight experiments (looking at you, Amir Khan) haven't ended well

• Eubank is facing a $500k fine for being over the agreed weight. With further fines on the way if he is over 170lbs. So a significant weight advantage is looking like it’ll be bigger than expected.

Between the lines: Benn's talking about standing and trading with the bigger man, which is about as smart as buying SafeMoon in 2021. Even if he boxes smart, Eubank's experience and size advantage should wear him down late.

The play: $10 on Eubank Jr. rounds 10-12 at 7/1 could turn into $80 (or of course, your crypto equivalent). Conor Benn’s appetite for a brawl shouldn’t be underestimated, but we feel the bigger man will naturally wear him down.

If you’re based in the USA, you’ll need to turn on your VPN to access this service

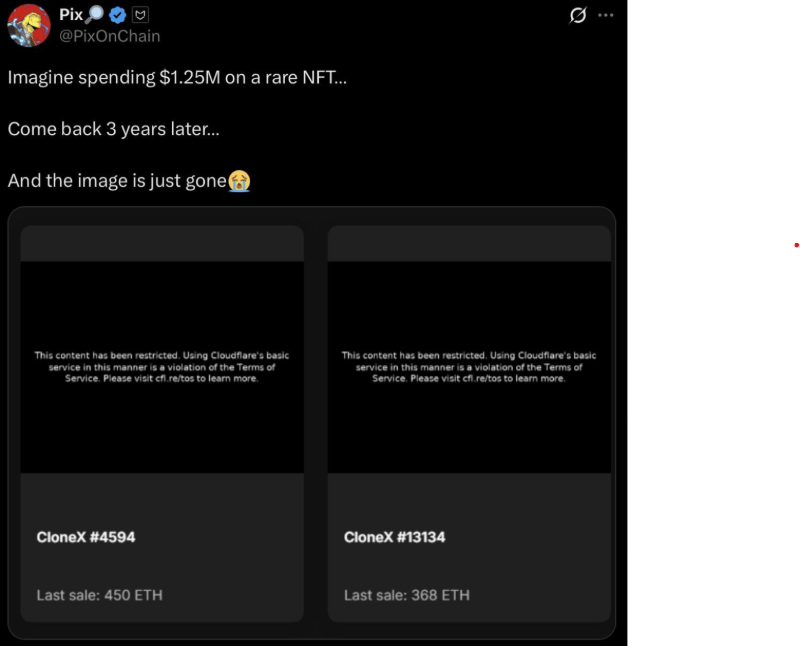

MEME OF THE WEEK

Sportsbets and casino > digital art

What did you think of today's newsletter? |